Introduction: Why Smart Borrowers Are Using AI for Loan & EMI Planning in 2026

In 2026, taking a loan in India is no longer just about finding the lowest interest rate. With floating rates changing frequently, hidden processing fees, and rising EMIs impacting monthly cash flow, one wrong decision can cost you lakhs over the loan tenure. This is where AI loan planning tools are changing the game.

Unlike traditional EMI calculators that simply show a monthly number, modern AI-powered tools analyze your income, existing EMIs, credit profile, and risk tolerance to recommend a safe and sustainable EMI range. They can simulate interest rate hikes, compare loan tenures, and even suggest the best prepayment strategy to reduce total interest burden.

Whether you are planning a home loan, personal loan, car loan, or business loan, using the right AI tools for loan & EMI planning can help you avoid financial stress and make smarter borrowing decisions.

In this guide, we will break down how these tools work, which ones are worth using in India, and how you can use AI to reduce your total loan cost intelligently.

Why Loan Planning in 2026 Is Riskier Than Ever

In 2026, loan planning in India has become more complex than ever before. Interest rates are no longer stable for long periods, especially in floating-rate home loans and personal loans. Even a 0.5% increase in interest can significantly raise your EMI and total repayment burden. Many borrowers still rely on basic EMI calculators, which only show monthly payments without considering future rate hikes, income risks, or multiple existing EMIs.

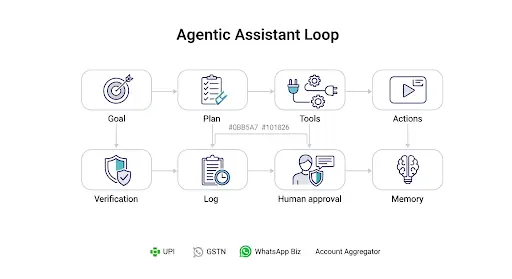

This is exactly where AI loan planning tools provide a major advantage. Instead of just calculating EMI, AI tools analyze your income stability, debt-to-income ratio (DTI), existing liabilities, and repayment capacity. They simulate different scenarios—such as interest rate increases or unexpected income drops—so you can understand the real long-term impact before taking a loan.

In 2026, smart borrowers are not asking “What is my EMI?” They are asking, “Is this EMI safe for my financial future?” Using AI tools for loan & EMI planning helps reduce risk, prevent over-borrowing, and protect your monthly cash flow from unnecessary stress.

What Are AI Loan Planning Tools? (Explained Simply)

AI loan planning tools are advanced financial tools that use algorithms and data analysis to help borrowers make smarter loan decisions. Unlike traditional EMI calculators that simply compute monthly payments based on loan amount, interest rate, and tenure, AI-powered tools go much deeper.

These tools analyze multiple financial factors such as your monthly income, existing EMIs, credit score range, spending habits, and repayment history. Based on this data, they recommend an affordable EMI range, ideal loan tenure, and even suggest whether you should reduce the loan amount. Some AI tools for loan & EMI planning can also compare loan offers from different banks, calculate prepayment savings, and highlight the total interest outflow over time.

In simple terms, traditional calculators answer “How much will I pay?”

AI tools answer “Should I take this loan, and how can I reduce its cost?”

For anyone planning a home loan, car loan, or personal loan in India, using AI-driven loan planning tools in 2026 is becoming a smarter and safer approach.

How AI Decides Your Safe EMI Range

One of the biggest mistakes borrowers make is choosing an EMI that looks affordable today but becomes stressful later. AI loan planning tools solve this problem by calculating your safe EMI range, not just the maximum EMI you qualify for.

Most banks approve loans based on income and basic eligibility rules. However, AI tools go deeper by analyzing your debt-to-income (DTI) ratio, fixed monthly expenses, savings rate, and financial goals. For example, if your monthly income is ₹80,000 and you already pay ₹15,000 in EMIs, AI tools assess how much additional EMI you can handle without crossing a risky threshold—usually 30–40% of income.

Advanced AI tools for loan & EMI planning also stress-test your loan. They simulate scenarios like a 1% interest rate increase or a temporary income drop to check whether your finances can still handle the EMI comfortably.

Instead of pushing you toward the highest loan amount, AI helps you stay within a financially safe zone—protecting your emergency fund, investments, and long-term stability.

Types of AI Tools for Loan & EMI Planning in 2026

Not all AI loan planning tools work the same way. In 2026, borrowers in India can choose from different types depending on their needs.

1. Smart EMI Calculators: These go beyond basic calculations by adjusting for floating interest rates, prepayment options, and total interest outflow.

2. Loan Comparison Platforms: AI-powered comparison tools analyze multiple bank offers, processing fees, and hidden charges to identify the most cost-effective loan option.

3. AI Prepayment Strategy Calculators: These tools show whether you should reduce tenure or EMI after making a lump-sum payment and calculate exact interest savings.

4. Credit-Linked Loan Optimizers: Some advanced platforms analyze your credit profile and suggest the best time to apply for a loan to secure lower interest rates.

Using the right combination of these AI tools for loan & EMI planning can significantly reduce your borrowing cost and improve financial decision-making in 2026.

Best AI Loan Planning Tools in India (2026)

Choosing the right AI loan planning tools can directly impact how much interest you pay over the life of your loan. In 2026, several smart platforms help borrowers analyze EMIs, compare loan offers, and plan prepayments effectively.

1. Smart EMI & Prepayment Calculators

Advanced online calculators now simulate floating interest scenarios, partial prepayments, and tenure adjustments. These tools are ideal for home loan borrowers who want to reduce long-term interest costs.

2. AI-Based Loan Comparison Platforms

Some fintech platforms use AI algorithms to compare bank offers, processing fees, and eligibility rules. Instead of manually checking each bank, borrowers can quickly identify the most affordable option.

3. Credit-Integrated Loan Advisors

These tools assess your credit profile and estimate approval probability. They help you apply at the right time to secure better interest rates.

When selecting AI tools for loan & EMI planning, focus on transparency, updated interest data, and scenario simulation features. The right tool can save you lakhs in interest over a 15–25 year tenure.

Real EMI Simulation: ₹25 Lakh Loan Example (2026)

Let’s understand how AI loan planning tools make a real difference using a practical example.

Assume you take a ₹25 lakh home loan in 2026.

- At 8.5% interest for 20 years, your EMI would be approximately ₹21,700, and total interest paid could exceed ₹27 lakh.

- If the rate increases to 9.75%, your EMI may rise above ₹23,500, increasing your total interest burden significantly.

- Extending tenure to 25 years reduces EMI but increases total interest dramatically.

Now here’s where AI tools for loan & EMI planning help. They simulate:

- Interest rate hikes

- Prepayment of ₹2 lakh after 3 years

- Tenure reduction vs EMI reduction comparison

For example, a ₹2 lakh prepayment in year 3 could reduce total interest by several lakhs depending on tenure choice.

Instead of guessing, AI-driven simulation gives clarity. It helps you decide whether to reduce tenure, refinance, or adjust EMI—based on real financial impact rather than assumptions.

Practical AI Training: Use ChatGPT to Simulate Loan EMI Risk

Now let’s move from theory to practical AI usage.

Instead of manually calculating EMIs or relying only on basic calculators, you can use AI to simulate loan scenarios, stress-test interest hikes, and evaluate prepayment impact within seconds.

Step 1: Open ChatGPT (or any advanced AI assistant)

You can use ChatGPT, Claude, or any AI model that supports structured calculations.

Step 2: Copy and Paste This Prompt

Act as a financial risk analyst.

Calculate EMI for a ₹25,00,000 home loan at 9% annual interest for 20 years.

Then simulate:

- EMI if interest increases to 10.5%

- Total interest difference between both scenarios

- Impact if I prepay ₹2,00,000 after 3 years

Present the results in a comparison table.

Step 3: Analyze the AI Output

When AI generates the results, focus on:

- EMI increase when interest rises

- Total interest burden over full tenure

- How early prepayment reduces overall cost

This helps you understand whether your EMI is safe under stress conditions, not just under ideal assumptions.

Advanced Prompt: Calculate Safe EMI Based on Income

Now refine your request:

Act as a financial planner.

My monthly income is ₹90,000 and I already pay ₹15,000 in EMIs.

Suggest a safe additional EMI range, keeping total EMIs under 35% of income.

Also calculate ideal loan amount I can safely take for 20 years at 9% interest.

Why This AI Exercise Matters

Instead of asking “What is my EMI?”, you are now asking:

- Is this EMI sustainable if interest rates rise?

- Can my income safely support this loan?

- Should I reduce tenure or prepay early?

This is how AI becomes a decision-support system — not just a calculator.

Practice Exercise for Readers

Try modifying:

- Loan tenure to 25 years

- Interest rate to 11%

- Add a second EMI

Observe how total interest and risk exposure change.

Repeat this exercise before taking any major loan decision.

How to Reduce Your EMI Using AI Strategy

Reducing EMI is not just about extending the loan tenure. In 2026, smart borrowers are using AI loan planning tools to optimize repayment strategy instead of blindly choosing lower monthly payments.

First, AI tools analyze whether increasing tenure actually benefits you. While a longer tenure reduces EMI, it significantly increases total interest paid. AI simulations compare tenure extension vs partial prepayment and show which option saves more money.

Second, AI tools for loan & EMI planning help identify the best time for prepayment. For example, making a lump-sum payment in the early years of a home loan reduces interest far more than paying the same amount later. AI calculators show exact interest savings based on timing.

Third, AI-driven balance transfer analysis compares your current interest rate with market rates. If refinancing reduces your rate by even 0.75%, the total interest savings over 20 years can be substantial.

Instead of emotional decisions, AI-backed loan strategy ensures your EMI remains affordable while minimizing long-term financial burden.

Common Mistakes to Avoid While Using AI Loan Planning Tools

While AI loan planning tools are powerful, they are only as good as the data you provide. One common mistake is entering inaccurate income or ignoring irregular expenses like insurance premiums, school fees, or annual subscriptions. This can lead to unrealistic EMI recommendations.

Another major mistake is focusing only on “lowest EMI.” A lower EMI often means longer tenure and higher total interest outflow. AI tools for loan & EMI planning should be used to analyze total repayment cost—not just monthly burden.

Many borrowers also forget to include processing fees, legal charges, and prepayment penalties in their calculations. Ignoring these costs can distort the comparison between lenders.

Finally, do not depend on AI tools alone. They are decision-support systems, not final decision-makers. Combine AI insights with financial discipline, emergency fund planning, and long-term goals.

When used correctly, AI tools improve clarity. When used carelessly, they can give a false sense of affordability.

Who Should Use AI Loan Planning Tools in 2026?

In 2026, AI loan planning tools are not just for tech-savvy users — they are essential for anyone taking a loan in India. Rising interest volatility and tighter bank underwriting make smart planning more important than ever.

Salaried professionals should use AI tools to ensure their EMI stays within a safe 30–40% debt-to-income ratio. If you already have a car loan or credit card EMIs, AI tools help calculate your true repayment capacity before applying for a home loan.

Self-employed professionals and business owners benefit even more. Since income can fluctuate monthly, AI tools for loan & EMI planning simulate cash-flow variations and recommend safer EMI structures.

First-time home buyers often underestimate long-term interest impact. AI simulations show the difference between 20 vs 25 years, fixed vs floating rates, and early prepayment strategies.

Even professionals managing multiple EMIs can use AI tools to decide whether to consolidate, refinance, or prepay. In short, anyone who wants to borrow responsibly in 2026 should consider AI-powered loan planning.

Final Verdict: Are AI Loan Planning Tools Worth It in 2026?

In 2026, borrowing without proper analysis is financially risky. Interest rates fluctuate, loan tenures stretch up to 25–30 years, and even a small rate difference can cost you several lakhs over time. This is why AI loan planning tools are no longer optional — they are becoming a smart financial necessity.

Unlike traditional EMI calculators, AI tools for loan & EMI planning evaluate affordability, simulate future rate hikes, compare lender offers, and recommend strategic prepayment options. They shift your focus from just “How much is my EMI?” to “Is this loan sustainable for my long-term financial goals?”

However, AI is a decision-support system — not a replacement for financial discipline. Use these tools to stress-test your loan, maintain a healthy debt-to-income ratio, and protect your emergency fund before committing.

If used correctly, AI-powered loan planning can reduce interest burden, improve cash-flow management, and prevent over-borrowing. In a high-cost credit environment like 2026, that advantage can make a significant difference to your financial future.

Smart borrowing starts with smart analysis — and AI makes that possible.

FAQs About AI Loan & EMI Planning (2026)

What are the best AI loan planning tools in India?

The best tools are those that offer EMI simulation, interest rate stress testing, prepayment analysis, and loan comparison features. Choose platforms that update rates regularly and show total interest cost.

Can AI reduce my loan interest rate?

AI cannot directly reduce your interest rate, but it can help you choose better lenders, plan prepayments smartly, and evaluate balance transfer options to lower overall cost.

Are AI loan planning tools accurate?

Yes, provided you enter correct income, expenses, and loan details. AI tools for loan & EMI planning use mathematical models and scenario simulations to provide realistic projections.

How much EMI is safe as per income?

Most experts suggest keeping total EMIs below 30–40% of your monthly income. AI tools automatically calculate this based on your financial data.

Should I prepay my loan or invest instead?

This depends on your loan interest rate and expected investment return. AI simulation tools can compare both options and show which strategy benefits you more over time.

You May Also Like

If you found this guide on AI Loan Planning Tools in India helpful, you may also want to explore:

- AI Credit Score Improvement: 7 Ways to Boost Your CIBIL Score

- How AI Can Help You Manage Personal Finance More Effectively

- Smart Finance with AI: A Complete Beginner’s Guide (2026)

Disclaimer: This article is for informational and educational purposes only and does not constitute financial, investment, or loan advice. Loan terms, interest rates, and eligibility vary by lender and individual profile. Please consult a qualified financial advisor or lender before making borrowing decisions.