From chat to assistants that do the work

As per my experience with Indian entities, CAs and corporate teams, most automation stalls not because tools are weak but because people are buried in glue-work copying values between sheets, chasing invoices, drafting the same emails, stitching evidence for audits. Agentic AI is different from chat. It plans, uses your approved tools, checks its work, keeps a log, and asks before risky actions. You remain in charge; the assistant prepares half the work so you can focus on judgment, review, and client conversations.

Executive summary

This Agentic AI article is a field guide to launching small, agentic assistants on India’s rails (UPI, GSTN, WhatsApp) and proving value with CFO-grade metrics. Start with collections, GST ITC reconciliation, and audit PBC packs; add HR onboarding or D2C support if finance is out of scope. Keep controls visible (DPDP, approvals, logs), use a minimal stack, and run a 30-60-90 plan.

Please see below the executive takeaways:

- What to ship first (low risk, high ROI):

Collections reminders (UPI links), GST 2B vs Purchase Register mismatches, and PBC working-paper packs. Add HR onboarding or D2C returns for non-finance teams. - Guardrails by design (audit-ready):

Purpose + minimal fields (DPDP), RBAC & allow-lists, verification checks (totals/PII), human approval before money/filings/mass messages, and run logs + monthly archives. - Metrics that matter (AgentOps):

TSR (Task Success Rate), IR (Intervention Rate), TTR (Time-to-Result), incidents, and check precision (e.g., mismatch accuracy). Review weekly with a change log. - Minimal stack (you likely have it):

Sheets/Excel + scripts (or Power Automate/n8n), WhatsApp Business, UPI payment links, Drive/SharePoint + Document AI, optional Copilot Studio/Dialogflow CX for complex flows. - ROI math (CFO-proof):

Benefit = (hours saved × blended rate) + (errors avoided × cost/error) + cash acceleration (A/R × CoC × DSO cut/365). Track cost (subs + messages + setup/12). Report ROI and payback. - 30-60-90 plan (ship → pilot → scale):

Days 0–30: 1-page spec, templates with notices, tiny dashboard.

Days 31–60: MVP on a small segment, no-send first, approvals mandatory, weekly pruning.

Days 61–90: retries/alerts/retention, runbook, backups—then add a second workflow. - Expected outcomes (from anonymised India rollouts):

Surat trading SME: DSO ↓ ~7 days in 8 weeks (steady cadence + frictionless UPI links).

Bengaluru SaaS: RevOps time ↓ ~60%, forecast error ↓ ~18% (nightly hygiene + renewal prep).

Mumbai CA: Partner review time ↓ ~35% (PBC nudges + evidence packs).

Points to remember

1. Start narrow and weekly measurable; promote only when metrics are stable.

2. Logs are a feature—they win audits and reduce escalations.

3. Exportability beats fancy UI: keep CSV/PDF outs and evidence packs.

4. If collections aren’t in scope, drop the cash term in ROI; the model still holds.

5. Share a Friday dashboard screenshot—visibility builds trust and momentum.

What is Agentic AI and How it differs from “AI agents”

An agentic AI assistant is a software teammate that takes a goal, breaks it into steps, calls allowed apps/APIs (Sheets/ERP, e-mail, WhatsApp Business, payment links), verifies results against rules, logs every step, and pauses for human approval on money, filings, and external messaging. On the other hand, AI agents are built for narrow tasks, answering queries, managing calendars, triaging email. They automate routine steps but lack autonomy: they follow preset rules and don’t make decisions or show initiative. Think of them as precise virtual assistants, not independent problem-solvers.

In my view, agentic AI is the capability and design principle, systems that show agency: planning + tool-use + verification + adaptation. AI agents are the specific applications built with that principle. Not every app called “agent” is agentic, some are just chatbots with a fancy skin.

Here is the key differences between AI agent vs Agentic AI

| Dimension | AI Agent | Agentic AI |

|---|---|---|

| Definition | App that executes a predefined task or workflow. | Capability/design that plans → acts (tools) → verifies → learns. |

| Autonomy & Planning | Low; follows fixed rules, little/no planning. | High; makes a plan, adapts steps, recovers from hiccups. |

| Tool Use | Uses a fixed tool in a fixed order. | Chooses among tools/APIs dynamically per step. |

| Verification & QA | Minimal; assumes success unless it fails. | Built-in checks (totals, schema, constraints) before final output. |

| Human-in-loop & Logs | Often basic approval; limited logging. | Approvals for risky actions + run logs/evidence packs. |

| Quick Test | Just executes? It’s an AI agent. | Plans + uses tools + verifies? That’s Agentic AI. |

Why 2025 is India’s moment for agentic AI

India now has the three ingredients agentic AI systems need to work in the real world: digital rails to move data and money, compute access to run modern models, and clear guardrails so teams can launch with confidence. In my view, this is the most practical window to run pilots on everyday business flows and then scale what proves reliable.

Below are the three enablers and what they mean in practice:

- Digital rails (ready today): UPI for instant payments and links, GSTN exports for reconciliations, WhatsApp Business for consented outreach, and Account Aggregator for permissioned financial data. Implication: agents can fetch, nudge, and reconcile without custom plumbing.

- Compute access (improving): National and cloud programs (e.g., IndiaAI initiatives) and expanding GPU availability reduce the barrier to running heavier models. Implication: proofs-of-concept don’t stall for lack of horsepower.

- Guardrails (clearer rules): DPDP Act norms on purpose, consent, and retention; sector expectations from SEBI/RBI. Implication: you can design templates and approvals that satisfy compliance from day one.

Example: A Pune distributor runs a collections agent on WhatsApp Business that sends UPI payment links and logs consent; the finance team reconciles receipts against GSTN exports weekly. Purpose and retention notes are baked into the message templates, and an approval step gates any escalations—clean, auditable, and fast.

Points to remember

1. Start with workflows that already ride UPI/GST/WhatsApp.

2. Write the purpose and consent path into specs and templates.

3. Prefer platforms with RBAC, exportable logs, and retention controls.

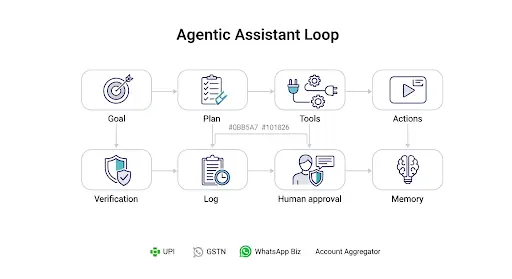

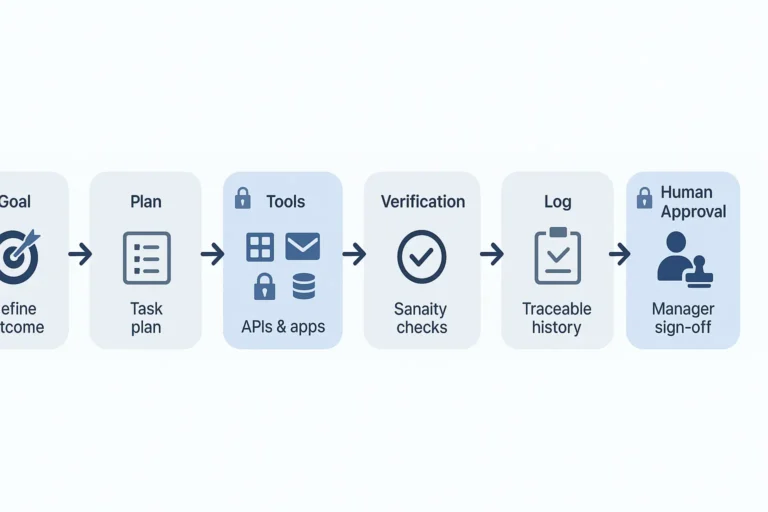

How an agentic AI assistant works (the loop)

An agentic ai assistant isn’t “just a bot.” It’s a disciplined loop that turns a goal into a checked, logged, human-approved outcome—then learns from edits. In simple words: you set the destination, it proposes the route, drives only the safe parts, stops for your approval, and keeps receipts for audit.

Below is the loop explained step-by-step:

- Goal — Define the outcome in one line so there’s no ambiguity.

Example goals: “Prepare a GST mismatch pack,” “Remind customers with pending invoices,” “Assemble monthly expense report.” - Plan — Before doing anything, the assistant shows its step list and inputs it will need (files, fields, dates). You confirm or tweak—this saves rework later.

- Tools (allowed only) — Agentic AI uses whitelisted connectors (Sheets/ERP, WhatsApp Business API, payment links, email) under your permissions—nothing outside the allow-list.

- Actions (low-risk by default) — Reads data, writes tables, drafts letters/messages, and prepares attachments. First runs can be draft-only/no-send until you’re comfortable.

- Verification — Built-in checks catch silly mistakes: totals match, GSTIN formats valid, PII redacted, required attachments present, due dates not in the past.

- Log (evidence) — Every run gets a timestamped log: inputs used, steps taken, checks passed/failed, and links to evidence files (CSV extracts, PDFs, draft emails). This is your audit trail.

- Human approval — Anything outward or risky (payments, filings, mass messages) pauses for your Approve/Reject. Approval notes are recorded in the log.

- Memory & learning — Your edits (tone, thresholds, exceptions) become rules for the next run, so iterations shrink and quality climbs.

Points to remember

1. Capture edits as rules (“always attach ledger CSV,” “use opt-out line on reminders”) so the assistant improves run by run.

2. Keep the first scope narrow and weekly measurable (one goal, one data source, one output).

3. Logs are part of the product, not a side effect—treat them like working papers.

4. Approval is a design step—place it exactly before money, filings, or bulk outreach.

5. Start in draft/no-send mode, then unlock sends once checks are stable.

The four building blocks (planner, tools, memory, feedback)

Planner turns a goal into steps (ReAct, SOP-style prompts, or Tree-of-Thoughts for complex branching). Tools are your permitted actions: read/write Sheets, send email, create UPI/Card links, parse PDFs, query ERP. Memory stores safe, summarised context what fixed an error last time, preferred phrases, common exceptions. Feedback blends automatic checks (schema/total) and human edits, which the assistant learns from.

Example: At 5 pm, a triage assistant reads exception POs, plans the next steps (check SLA → stock → alternative supplier), drafts ticket notes, and flags what needs manager sign-off. Within three weeks of applying feedback, rework time fell sharply.

Points to remember

• Start with explicit rules; add “learning” later.

• Keep memory scoped and de-identified; set retention windows.

Patterns that work (without coding theory)

You don’t need PhD papers, but picking the right pattern matters.

- ReAct: think‑then‑act with tool calls—default for business flows.

- Tree‑of‑Thoughts: explore multiple plans; pick the best—useful for complex reconciliations.

- Self‑consistency/Reflexion: try variations, choose via checks, store what worked.

- Multi‑agent handoff: small specialists (extract → validate → draft → QC) when a single agent becomes bloated.

Example: Two agents split KYC onboarding—one extracts fields, another validates rules and drafts a discrepancy note. Manager approves only exceptions. The queue shrank; accuracy rose.

Points to remember

- One simple ReAct agent beats a fragile swarm.

- Add agents only when a single flow hits complexity limits.

Persona-wise wins (students, freelancers, SMEs, corporates, CAs)

- Students: a study coach that lays out a four-week plan, drafts flashcards, quizzes progress and keeps a ledger parents can see.

- Freelancers: proposal writer from a client brief; one-click invoice + reminders; project updates.

- SME owners: twice-weekly dunning with invoice PDF + UPI link; vendor chasers; weekly MIS draft.

- Corporate professionals: policy drafts with citations; email triage; MIS refresh with checks.

- CAs: PBC tracker; sampling agent; working-papers assembly with evidence packs.

Points to remember

- Choose repetitive, rule-bound work first.

- Insert human checks before any external send.

- Save before/after output for auditability.

Finance playbooks

These are practical, low-risk assistants you can launch on UPI/GST/WhatsApp rails and scale once metrics look good.

Please see below the top workflows and how to run them:

1) Collections (dunning) agentic ai assistant

Cash flow improves when reminders are steady, polite, and frictionless (UPI/card links). Start simple; add nuance only after you see CTR and pay-within-7-days lift.

Please see below the flow and checks:

- What it does: Reads ageing, segments customers, drafts WhatsApp/email with invoice PDF + one-tap UPI/card link, routes disputes, logs every step.

- Cadence: Mon/Thu; auto-skip if payment recorded.

- Guardrails: Manager approval for high-value/legal accounts.

- KPIs: DSO, promise-to-pay rate, link CTR, paid-within-7-days.

Example: A trading SME ran a twice-weekly cadence. In eight weeks, DSO improved ~7 days—the win came from steady cadence + easy links, not fancy prose.

Points to remember

- Use approved WhatsApp templates and an opt-out line.

- Maintain a do-not-contact list.

- Export run logs weekly (audit + customer care).

2) GST ITC reconciliation Agentic AI assistant

Make Fridays light: let the assistant prep mismatches and drafts; you review tone and exceptions.

Please see below the flow and checks:

- What it does: Pulls GSTR-2B + purchase register, flags mismatches (GSTIN/amount/date), drafts vendor emails, saves an evidence pack (Excel + PDFs).

- Guardrails: No vendor email goes without human approval.

- KPIs: % matched, aged mismatches, vendor response time.

Example: A half-day Friday task became a 15-minute review because drafts and evidence were ready and neatly indexed.

Points to remember

- DPDP basics: purpose, minimisation, retention—don’t store more than needed.

- Keep before/after reconciliations for auditors.

- Archive monthly into read-only packs.

3) Audit PBC + working-papers agentic ai assistant

Consistency beats speed when auditors ask “show me.” Standardise nudges, file names, and evidence stitching.

Please see below the agentic ai flow and checks:

- What it does: Tracks PBC owners/due dates, nudges politely, stitches evidence + reviewer notes into a bookmarked pack.

- Guardrails: Approvals for any external share.

- KPIs: On-time % of PBC items; review cycles per paper.

Points to remember

- Standardise folder structure and file names.

- Keep a change log per paper.

- Lock finals as read-only.

HR onboarding agentic ai assistant

A friendly, predictable first week reduces tickets and time-to-productivity.

Please see below the agentic ai flow and checks:

- Flow: Offer → secure doc collection with notice → account provisioning → calendar + first-week plan.

- Guardrails: RBAC (Role based access control); delete KYC scans per retention.

- KPIs: Days-to-productivity; missing-access tickets.

Points to remember

- State purpose & consent in forms/messages (DPDP).

- Keep messages short, polite, traceable.

D2C returns / customer support

Quick, clear WhatsApp flows lower calls and raise CSAT.

Please see below the flow and checks for agentic ai workflow:

- Flow: Template → order lookup → reason/photos → ticket → pickup schedule → concise summary to customer.

- Guardrails: Opt-out keyword; human handover if confused.

- KPIs: First-response time; resolution time; CSAT.

Points to remember

- Review templates quarterly.

- Log opt-outs and escalations.

Evaluation that actually helps (AgentOps metrics)

Agentic AI isn’t “set and forget”; you need a tiny, honest scoreboard.

Please see below the agentic ai evaluation harness:

- Task Success Rate (TSR) — finished correctly without rework.

- Intervention Rate (IR) — % runs needing human fix.

- Time-to-Result (TTR) — minutes from start to approved output.

- Incident Rate — broken checks or escalations.

- Precision on checks — e.g., mismatch accuracy.

Points to remember

- Review weekly and keep a change log.

- Kill or fix steps that add no value.

One-screen outcomes table (update weekly)

Replace sample numbers with your live metrics; show it every Friday.

| Task | Baseline mins | After mins | TSR | IR | Net hours saved/mo |

|---|---|---|---|---|---|

| Collections reminder batch | 90 | 15 | 0.86 | 0.18 | 10 |

| GST 2B vs PR reconciliation | 240 | 25 | 0.81 | 0.22 | 14 |

| PBC evidence pack | 180 | 30 | 0.78 | 0.25 | 12 |

Points to remember

- Track hours, quality, cash—not vanity metrics.

- Screenshot and share in the team channel.

ROI math (CFO-proof and transparent)

Finance leaders back projects that show clear, conservative math. Keep the formulae simple, publishable, and easy to audit.

Please see below the formula for saving in hours and benefit you may derive from agentic ai:

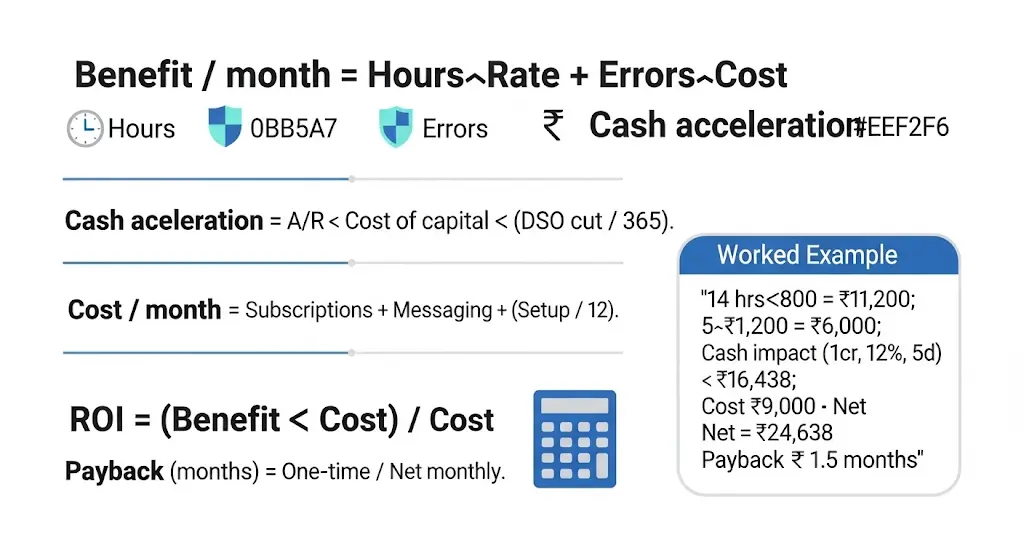

- Benefit / month = (Hours saved × blended hourly cost) + (Errors avoided × cost/error) + (optional) Cash acceleration.

- Cash acceleration = A/R × cost of capital × (DSO days cut / 365).

- Cost / month = Tool subscriptions + messaging fees + (one-time setup / 12).

- ROI = (Benefit − Cost) / Cost.

- Payback (months) = One-time / Net monthly.

Worked example (illustrative):

14 hrs × ₹800 = ₹11,200; 5 errors × ₹1,200 = ₹6,000; Cash impact (A/R ₹1 crore, CoC 12%, 5-day DSO cut) ≈ ₹16,438; Cost ₹9,000/mo → Net ≈ ₹24,638 → Payback ≈ 1.5 months.

Points to remember

- If collections aren’t in scope, drop the cash term—the math still holds.

- Publish the ROI sheet and let finance audit it.

Safety by design (map controls to the loop)

Controls should be visible in the run log of ai agentic assistant, not buried in a policy PDF. Tie each safeguard to a specific stage in the agentic ai loop.

Please see below the control map:

- Goal / Plan: write the purpose and minimal fields (DPDP principle).

- Tool calls: RBAC scopes, allow-listed domains, test mode for payments.

- Verify: schema checks, totals, and no PII in outbound via regex.

- Approve: money, filings, mass messaging → manager sign-off.

- Log / Retain: per-run log + evidence pack; delete temp files; monthly archive.

Points to remember

- Train teams to use the kill switch calmly.

- Review vendor DPAs and data locations.

Minimal stack that works (you likely have it)

Start no-code/low-code; only add complexity when the metrics justify it.

Please see below the minimal stack:

- Data & logic: Sheets/Excel + scripts, or low-code (Power Automate, n8n).

- Messaging: WhatsApp Business (provider or Meta Cloud API).

- Payments: Payment links (UPI/card) riding national UPI rails.

- Docs: Drive/SharePoint + Azure Document Intelligence or Google Document AI.

- Orchestration: Copilot Studio / Dialogflow CX when flows get complex.

Points to remember

- Prefer platforms with exportable logs.

- Avoid hard lock-in; keep CSV/PDF outputs.

Build vs buy (Agentic AI)

Buy common, repeatable flows; build when your process is the edge.

Please see below the quick guide:

- Buy if: WhatsApp reminders, payment links, ticket updates, OCR-to-sheet.

- Build if: Special approval matrices, custom evidence packs, arcane ERP rules.

Points to remember

- Start buy → add a thin custom layer for your secret sauce.

- Exportability + logs beat clever UIs.

30-60-90 AgentOps plan (dev + ops + compliance)

Small > grand. Ship a tiny pilot in 30 days, harden by 60, scale by 90.

Please see below the phased plan:

- Days 0–30 (Design & guardrails): 1-page spec (goal/IO/owners/risk/success), draft templates (notice + opt-out), tiny dashboard (hours, TSR/IR/TTR, incidents).

- Days 31–60 (MVP & pilot): Ship minimum steps; run on a small segment; no-send mode first; approvals mandatory; weekly review to prune waste.

- Days 61–90 (Harden & scale): Add retries, alerts, retention; write a runbook; train backups; only now add a second workflow.

Points to remember

- Reserve 2 hours/week for maintenance.

- Promote only when metrics are stable.

- Celebrate one clear win to earn buy-in.

India Rollout Stories: Measurable Wins

Real teams, small habits, measurable wins—no magic required.

Please see below the snapshots:

- Surat trading firm (collections): Twice-weekly reminders with invoice PDFs + UPI links; disputes routed to a human. DSO ↓ ~7 days in eight weeks; a template rewrite boosted replies.

- Bengaluru SaaS (RevOps): Nightly CRM hygiene; stuck quotes flagged; renewals prefilled. Manual RevOps time ↓ ~60%; forecast error ↓ ~18%.

- Mumbai CA practice (PBC): Nudges on due items; working-paper packs assembled. Partner review time ↓ ~35%; audit queries fell thanks to clean logs.

Points to remember

- Cadence + clean links beat clever prose.

- Evidence packs = fewer escalations.

- Keep messages short, polite, measurable.

Myth-busting

Clear confusion upfront; it prevents bad buys and keeps readers.

Please see below the truths that matter:

- Agent ≠ chatbot: agents act with tools; chatbots just reply.

- Agent ≠ Robotic Process Automation: RPA clicks screens; agents plan + verify.

- Hallucinations are controllable: use structured data + verification + approvals.

- DPDP isn’t a blocker: it’s a design guide (purpose, consent, minimisation, security, retention).

- Lock-in is optional: keep exports and modular connectors.

The Friday dashboard (one screen your CFO will read)

Make decisions, not dashboards. If a metric isn’t used, drop it.

Please see below the five tiles:

- Operations: hours saved, tasks completed, exceptions.

- Quality: edits per run; error rate before/after.

- Cash (if relevant): promise-to-pay, paid-within-7-days, DSO trend.

- Risk: approvals taken, messages blocked, incidents.

- Change log: “What we improved this week.”

Points to remember

- If a metric isn’t used in a decision, remove it.

- Post a screenshot in the team channel—visibility builds trust.

Conclusion: small scope, safe design, boring ROI

Agentic AI is not a toy; it moves glue‑work off people and gives time back for judgment and trust. India’s rails (UPI, GSTN, WhatsApp), improving compute (IndiaAI Mission), and clear guardrails (DPDP/SEBI/RBI) make 2025 the most practical year to start. Begin with one workflow, insist on approvals and logs, and measure weekly. In my view, teams that treat privacy and approvals as design inputs and keep metrics boring scale faster—and sleep better.

FAQ-Agentic AI

Q: What is “agentic AI” in plain English?

A: It’s an assistant that plans steps, uses your tools, checks results, logs actions, and pauses for human approval on risky tasks. Think “software teammate” rather than a chat window.

Q: How is agentic AI different from an AI agent?

A: Agentic AI is the capability (plan‑act‑verify‑learn). An “AI agent” is any app labeled agent; some are just chatbots. Look for plans, tool‑use, checks, logs, and approvals.

Q: Can small Indian businesses start without heavy IT?

A: Yes. Use Sheets/Excel, WhatsApp Business, and payment links. Start with one cadence and human approvals. India’s rails (UPI, GST exports) make pilots practical without custom back‑ends.

Q: Is sending automated reminders legal?

A: Use notice/consent, allow opt‑out, and respect do‑not‑contact lists. The DPDP Act emphasises purpose limitation, minimisation, security, and retention—design around those principles.

Q: Which finance workflows pay back fastest?

A: Dunning with UPI links, GST 2B vs purchase‑register reconciliation, and PBC/working‑papers assembly. They’re repetitive, measurable, and ride India’s rails.

Q: What metrics prove value?

A: Track hours saved, Task Success Rate (TSR), Intervention Rate (IR), time‑to‑result, and incidents. For collections, add paid‑within‑7‑days and DSO trend

Q: Do I need GPUs to start?

A: No. Use managed cloud models and APIs. The IndiaAI Mission expands compute nationally, but most pilots run fine on hosted services.

Q: How do I prevent risky actions?

A: Put approvals on money, filings, and mass messages. Use scoped permissions, allow‑listed domains, and a kill switch. Keep exportable logs for audits.

Q: Where should memory live?

A: Store summarised rules and past fixes, not raw PII. Add retention windows and auto-delete temp files. That aligns with DPDP’s minimisation and retention principles.

Q: Is multi‑agent better than one agent?

A: Not at the start. One ReAct agent with checks is simpler and more reliable. Split into specialist handoffs only when a single flow becomes bloated.

Q: How should a CA firm begin?

A: Start with a PBC tracker assistant. Agree owners and due dates, send polite nudges, compile an evidence pack, and keep partner approvals. Measure on‑time % and review time.

Q: What’s the role of SEBI/RBI guidelines?

A: SEBI expects AI/ML reporting and has consulted on responsible AI use. RBI pushes cyber‑resilience and secure payment operations for PSOs. Logs and approvals help documentation.

Q: Will assistants replace jobs?

A: They mostly remove repetitive glue‑work. Humans still set goals, handle exceptions, and build relationships. Most wins are faster cycles and cleaner records, not headcount cuts.

Q: How often should we update the assistant?

A: Weekly. Tweak templates, add exceptions, and prune unused steps. Publish a tiny change log alongside metrics so stakeholders see steady progress.

Q: Build or buy?

A: Buy the common plumbing (WhatsApp, payment links, OCR). Build your differentiators (approvals matrix, evidence packs). Always choose tools with exports and audit logs.

Disclaimer

This article is for educational purpose and not financial, investment, tax, or legal advice. Apply professional judgment. Follow the DPDP Act, 2023 and sector rules (e.g., SEBI in capital markets; RBI for payments/PSOs). Obtain consent/notice where required and retain/delete data as per policy.

Further reading

- AI Agents: The New Workforce Revolutionising Your Job in 2025

- GST Reverse Charge Mechanism (RCM) – 2025 Guide