AI credit score improvement is no longer optional if you’re planning a home loan, car loan, or credit card upgrade in India.

Have you ever been shocked by a low CIBIL score just when you needed a loan?

You paid your EMIs on time. You use your credit card responsibly. Yet your credit score isn’t improving — or worse, it dropped without warning.

The reality is simple: credit scoring today is data-driven, behavioural, and increasingly AI-powered. Banks use advanced algorithms to assess your risk profile. If you are not tracking your credit behaviour intelligently, you may be damaging your score without realising it.

In this guide, you’ll learn:

• What actually reduces your credit score in India

• How AI tools analyse your financial behaviour

• Practical ways AI can help improve your CIBIL score

• Real examples and a 90-day improvement blueprint

If you’re planning a home loan, car loan, or credit card upgrade, this guide could save you lakhs in interest.

What Is a Credit Score & Why It Matters for Loans in India

Your credit score (commonly known as CIBIL score in India) is a three-digit number between 300 and 900 that reflects your creditworthiness. A score above 750 is generally considered strong for loan approvals.

Banks do not manually “judge” your application anymore. Instead, AI-based underwriting systems assess your credit behaviour — repayment consistency, credit utilisation ratio, credit mix, and enquiry history — before approving loans.

For example, consider a ₹30 lakh home loan over 20 years. A borrower with a 680 score may receive an interest rate of 9.5%, while someone with a 780 score could get 8.6%. That small difference can mean savings of several lakhs over the loan tenure.

As per our experience working in finance and analysing borrower profiles, most score drops happen due to behavioural patterns — not major defaults. This is exactly where AI credit score improvement tools can make a measurable difference by identifying risks early.

What Actually Lowers Your Credit Score in India (Hidden Triggers)

Many borrowers believe only missed EMIs reduce their credit score. In reality, several behavioural factors quietly impact your CIBIL score — even if you pay on time.

The most common trigger is high credit utilisation ratio. If your total credit limit is ₹1,00,000 and you consistently use ₹70,000, your 70% utilisation signals higher risk to lenders. Ideally, it should remain below 30%.

Frequent loan or credit card applications also reduce your score because each hard enquiry is recorded. Similarly, closing old credit cards shortens your credit history, which can negatively impact long-term scoring models.

Buy Now Pay Later (BNPL) usage is another emerging factor. As per our experience analysing borrower credit behaviour, many young professionals damage their credit score due to multiple small BNPL accounts that increase active credit exposure.

Even minor reporting errors in your credit report can lower your score without your knowledge. This is where AI credit score improvement tools help detect anomalies early.

How AI Analyses Your Credit Behaviour

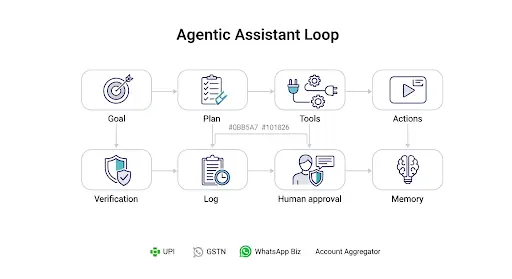

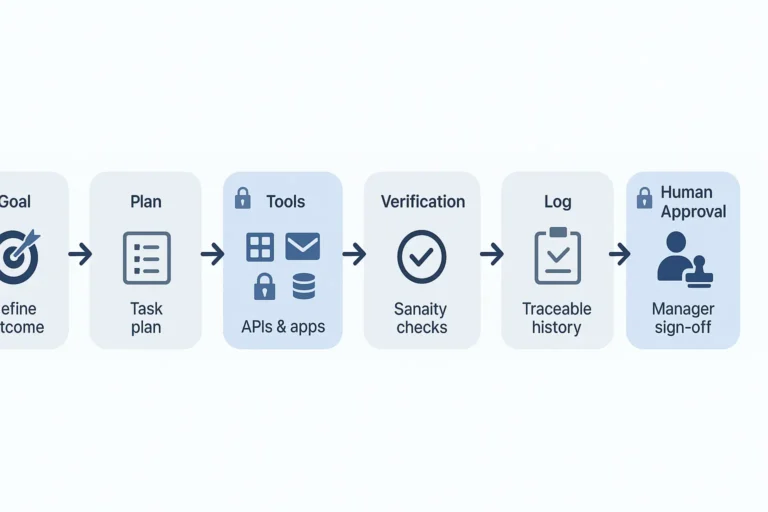

Modern lenders use AI-driven underwriting models that go beyond simple repayment history. These systems analyse patterns — not just events.

AI tracks spending frequency, repayment consistency, credit utilisation trends, and enquiry behaviour over time. Instead of looking at a single missed payment, it studies behavioural risk signals.

For example, if your credit card usage is gradually rising month after month, an AI-based credit monitoring tool may flag that you are likely to cross the 30% safe utilisation threshold soon. This early warning allows corrective action before your score drops.

Some advanced AI credit score improvement platforms also simulate “what-if” scenarios. For instance, reducing your outstanding balance by ₹25,000 may show a projected score increase over the next billing cycle.

As per our experience in financial analysis, proactive monitoring — not reactive correction — is the key difference between stable and declining credit scores. AI makes this monitoring automatic and data-driven.

7 Practical Ways AI Can Help Improve Your Credit Score

AI credit score improvement is not about shortcuts — it is about behavioural optimisation. Here are seven practical ways AI-powered tools can help:

1. Smart Payment Alerts: Automated reminders prevent even a one-day EMI delay.

2. Credit Utilisation Monitoring: AI tracks usage patterns and alerts you before crossing the 30% threshold.

3. Spending Pattern Analysis: Identifies high-risk behaviour trends.

4. Credit Report Error Detection: Flags inconsistencies across bureaus.

5. Score Impact Simulation: Predicts how paying down debt affects your score.

6. Enquiry Management Alerts: Warns against frequent loan applications.

7. Credit Mix Suggestions: Recommends balanced credit exposure over time.

📌 Example:

Rahul had a 720 CIBIL score. His AI monitoring app showed 62% credit utilisation. He prepaid ₹40,000, bringing it below 30%. Within 45 days, his score improved to 748.

As per our experience, small behavioural corrections often lead to measurable score improvement within 60–90 days.

Best AI-Powered Credit Monitoring Tools in India

Several fintech platforms in India now offer AI-driven credit monitoring features that help users track and optimise their credit behaviour. While no tool can instantly increase your score, the right platform can support AI credit score improvement through alerts, analysis, and behavioural insights.

Some widely used platforms include:

- CRED – Offers credit score tracking and repayment insights for credit card users.

- OneScore – Provides free credit score monitoring without advertisements.

- Paisabazaar – Credit monitoring along with loan comparison tools.

- Experian (India app) – Direct bureau-based credit report access.

- INDmoney – Tracks credit score alongside investments and financial planning.

When choosing a tool, focus on features that genuinely support improvement:

| Feature | Why It Matters |

|---|---|

| Real-time alerts | Prevents missed EMIs |

| Utilisation tracking | Keeps usage below 30% |

| Report monitoring | Detects bureau errors |

| Score simulation | Predicts impact of repayment |

As per our experience, the most effective AI credit score improvement strategy is not tool-hopping — it is consistent monitoring and disciplined correction of behavioural risks.

How Long Does It Take to Improve Your Credit Score?

One of the most common questions around AI credit score improvement is: how fast can the score actually increase?

The answer depends on the reason for the decline. If your score dropped due to high credit utilisation, improvement can begin within 30–45 days after reducing balances below 30%. However, missed EMIs, loan settlements, or defaults may take several months to stabilise.

For example, if your credit card utilisation reduces from 70% to 25%, you may see a positive movement in the next reporting cycle. But if you have multiple delayed payments in the last 6 months, behavioural consistency over at least 90 days becomes critical.

As per our experience, AI tools accelerate awareness — not miracles. They help prevent further damage and guide disciplined corrections. Sustainable credit score improvement typically requires 60–90 days of consistent financial behaviour.

90-Day AI Credit Score Improvement Blueprint

If you want structured results, follow this simple 90-day framework.

Week 1: Assessment Phase

- Download your latest credit report

- Identify utilisation ratio and active loans

- Install one AI-powered credit monitoring tool

Month 1: Correction Phase

- Reduce credit utilisation below 30%

- Set auto-debit for all EMIs

- Avoid new loan enquiries

Month 2: Stabilisation Phase

- Maintain low utilisation

- Clear small outstanding balances

- Monitor score changes

Month 3: Optimisation Phase

- Consider improving credit mix if needed

- Continue disciplined repayment pattern

📌 Example:

A borrower reduced utilisation, avoided new enquiries, and set auto-pay for 3 months. His score moved from 705 to 742 — without taking new credit.

As per our experience, structured discipline supported by AI monitoring delivers measurable and sustainable results.

Final Verdict: Can AI Really Improve Your Credit Score?

AI cannot magically erase past defaults or instantly raise your CIBIL score. But it can significantly improve how you manage credit behaviour.

Modern lenders already use AI-based underwriting systems to assess repayment patterns, utilisation trends, and risk signals. When you use AI-powered monitoring tools yourself, you gain visibility into the same behavioural metrics that affect approval decisions.

The real advantage of AI credit score improvement lies in prevention. It alerts you before utilisation crosses safe limits, reminds you of due payments, detects reporting errors, and discourages unnecessary loan enquiries.

As per our experience analysing financial profiles, most credit score declines happen due to avoidable behavioural patterns — not major financial distress. AI helps eliminate these small but damaging mistakes.

If you are planning a home loan, car loan, or premium credit card, proactive monitoring for 60–90 days can make a measurable difference in both approval probability and interest rate.

AI is not a shortcut. It is a discipline amplifier.

Key Points to Remember

- Your CIBIL score (300–900) directly impacts loan approval and interest rates. Even a 50–70 point difference can save lakhs over a long-term loan.

- High credit utilisation (above 30%) is one of the fastest ways to reduce your credit score — even if you pay on time.

- Multiple loan applications within a short period increase hard enquiries and lower your score.

- AI credit score improvement tools do not increase your score directly — they help optimise behaviour that affects scoring models.

- Real-time alerts, utilisation tracking, and EMI automation are the most valuable AI-driven features.

- Most credit score improvements happen within 60–90 days if behavioural corrections are consistent.

- Monitoring your own credit report does not reduce your score (soft enquiry).

- As per our experience, prevention is more powerful than correction. AI works best when used proactively before applying for a loan.

Frequently Asked Questions (FAQ)

Can AI directly increase my credit score?

No. AI does not directly change your score. It helps you monitor, optimise credit utilisation, automate payments, and avoid risky behaviour that reduces your score.

How much can my CIBIL score improve in 3 months?

If the issue is high utilisation or frequent enquiries, improvement of 20–40 points within 60–90 days is possible with disciplined correction. Defaults or settlements may take longer.

Does checking my credit score reduce it?

Checking your own credit score through monitoring apps is considered a soft enquiry and does not reduce your CIBIL score. Multiple loan applications (hard enquiries) can impact it.

What is the ideal credit utilisation ratio?

Ideally, keep total credit utilisation below 30% of your available limit. Lower ratios generally indicate lower risk to lenders.

Which is the best AI credit score improvement app in India?

There is no single “best” app. The right tool should offer real-time alerts, utilisation tracking, report monitoring, and score update features. Consistency matters more than brand selection.

You May Also Like

If you found this guide on AI credit score improvement helpful, you may also want to explore:

- How AI Can Help You Save Money Every Month – Discover smart AI tools that analyse your spending habits and reduce unnecessary expenses.

- AI Budgeting Tools to Track Expenses Automatically – Learn how automation can help you control cash flow and improve financial discipline.

- Using AI to Manage Personal Finance in India – A complete guide to AI-powered financial planning and wealth management strategies.

- Best AI Expense Tracker Tools for Professionals – Compare top tools designed for working professionals and business owners.

Disclaimer

This article is for educational and informational purposes only and does not constitute financial or credit advice. Credit score improvements depend on individual financial behaviour and bureau reporting cycles. Always verify information directly with your credit bureau or financial institution before making borrowing decisions.