Introduction: Why Smart Finance with AI Matters in India

Money has always played a central role in Indian households. We grow up learning the importance of saving, planning for the future, and being careful with expenses. Yet, even today, many people feel unsure about their financial decisions. Not because they don’t earn enough, but because managing money has quietly become more complicated.

In recent years, the way Indians handle money has changed rapidly. Salaries are credited digitally, payments happen instantly through UPI and cards, and expenses are spread across multiple apps and platforms. At the same time, financial products, loans, investments, and subscriptions are constantly competing for attention. Amid all this, most people still rely on habit, memory, or occasional reviews to understand their finances.

This gap between how fast money moves and how slowly we understand it is where problems begin.

Smart Finance with AI addresses this gap.

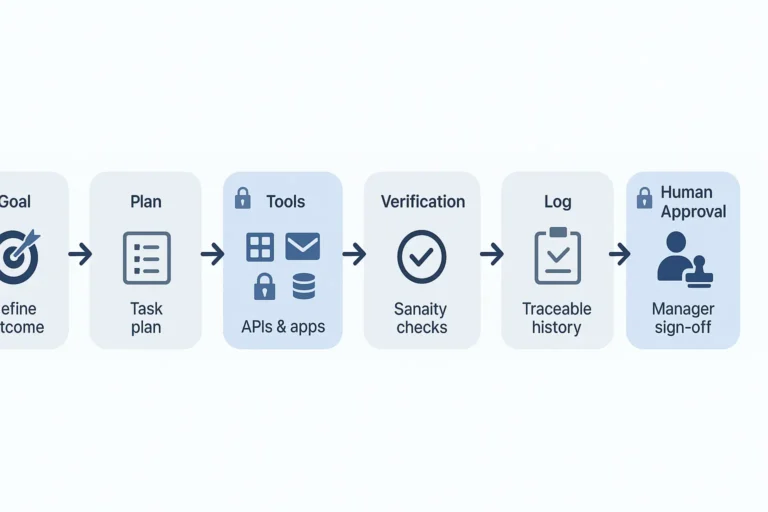

Artificial Intelligence, in the context of personal finance, is not about machines taking control of your money. It is about using intelligent systems to observe patterns, highlight important signals, and bring clarity where there is confusion. AI does not replace human judgement; it supports it by showing a clearer picture of what is actually happening with your money.

For India, this shift is particularly meaningful. Rising living costs, irregular income patterns, side hustles, education loans, EMIs, and family responsibilities all place pressure on personal finances. Many people want to make better decisions but don’t know where to start or what to trust. AI helps by reducing noise and focusing attention on what truly matters.

This guide has been written to make that understanding simple.

It is meant for students who want to learn about money early, beginners who find finance overwhelming, working professionals trying to save better, and anyone curious about how artificial intelligence fits into everyday life. The language is intentionally simple, the explanations are practical, and the focus is on clarity rather than complexity.

There are no promises of quick wealth or perfect financial outcomes here. Instead, the goal is to help you understand how AI can quietly improve everyday financial decisions — one small insight at a time.

Before we explore tools, benefits, or future trends, it is important to clearly understand what Smart Finance with AI actually means. Once that foundation is in place, everything else becomes easier to grasp.

In the next section, we will break down the concept of Smart Finance with AI in simple, everyday language.

What Is Smart Finance with AI?

To understand Smart Finance with AI, it helps to first remove the fear around the word artificial intelligence.

In everyday life, AI is simply a system that can observe, learn, and suggest. It looks at patterns in data, understands what usually happens, and then helps predict or improve what comes next. In finance, this ability is used to make sense of money-related behaviour that is otherwise hard to track manually.

Smart Finance with AI means using such intelligent systems to understand your personal or business finances more clearly. Instead of only showing numbers, these systems try to explain what those numbers actually mean.

Traditionally, finance tools worked like mirrors. They reflected information back to you — how much you earned, how much you spent, and what balance remained. AI-powered finance works more like a guide. It doesn’t just show what happened; it helps you understand why it happened and what you can do next.

The key difference lies in how the system behaves.

A normal tool waits for you to act.

An AI-driven system observes continuously.

It quietly notices patterns such as:

- Where money flows regularly

- Which expenses are increasing slowly over time

- When spending behaviour changes

- How income and expenses move together

Most people don’t consciously notice these patterns because they develop gradually. AI does.

Another important point to understand is that Smart Finance with AI is not about control. It does not take decisions on your behalf. It does not move money without permission. Instead, it provides insights so that you can take better decisions with more confidence.

This is especially useful for beginners.

When someone is new to managing money, the hardest part is not discipline — it is awareness. AI helps build that awareness gently, without forcing complex rules or financial theory.

In simple terms, Smart Finance with AI helps you:

- See your money more clearly

- Understand your habits without judgement

- Spot problems early

- Make small improvements consistently

Over time, these small improvements compound.

As AI systems learn from past data, their suggestions become more relevant. The more consistently they are used, the better they become at highlighting what truly matters and ignoring unnecessary noise.

Now that the concept is clear, the next natural question is how this actually works in real life. How does AI help with expenses, budgeting, saving, investing, and safety on a day-to-day basis?

That is exactly what we will explore next.

In the next section, we’ll look at how AI is quietly transforming personal finance in India — one everyday decision at a time.

How AI Is Transforming Personal Finance in India

AI is not changing personal finance in India through big announcements or dramatic shifts. Its real impact is far quieter. It is improving the small, everyday decisions people make with money — decisions that usually go unnoticed but shape long-term financial health.

Most Indians don’t struggle because they make terrible financial choices. They struggle because they don’t see the full picture clearly and in time. AI helps by bringing that clarity earlier, when it still matters.

Making Everyday Spending Visible

One of the biggest challenges in personal finance is not overspending, but invisible spending.

Small payments made through UPI, cards, and apps feel harmless in isolation. Over time, however, they add up. AI systems help by automatically analysing transactions and showing spending patterns that are easy to miss when looking at bank statements manually.

When people finally see where their money is actually going, behaviour often changes naturally. There is no pressure, no strict rule — just awareness.

Budgeting That Adjusts to Real Life

Traditional budgeting assumes life is predictable. In reality, it rarely is.

Indian households deal with variable expenses like festivals, school fees, medical needs, travel, and family responsibilities. AI-based budgeting works better because it adapts. Instead of fixed limits, it looks at past behaviour and current trends to suggest budgets that are realistic rather than ideal.

This makes budgeting feel supportive instead of restrictive.

Helping People Save Without Feeling Deprived

Saving money is often associated with sacrifice, but AI approaches it differently. Instead of asking people to cut deeply, it focuses on small inefficiencies that can be improved quietly.

AI highlights patterns such as:

- Expenses that are rising slowly without notice

- Payments that no longer add real value

- Spending habits that don’t align with personal goals

These insights help people save without drastically changing their lifestyle. Over time, even small monthly savings begin to feel meaningful.

Making Investing Less Intimidating

For many Indians, investing feels confusing or risky, especially for beginners. AI helps by simplifying the process and reducing emotional decision-making.

Instead of reacting to short-term market noise, AI systems focus on consistency, goals, and risk alignment. This doesn’t mean they remove risk, but they help people understand it better and respond more calmly.

As a result, investing starts to feel like a long-term habit rather than a stressful activity.

Improving Financial Safety in a Digital Economy

As digital payments grow, so do risks related to fraud and unusual activity. AI plays an important role here by monitoring patterns and flagging behaviour that looks out of place.

This added layer of intelligence improves confidence in digital finance, especially for people who are cautious about online transactions.

Why This Transformation Feels Different

The most important change AI brings is not speed or automation. It is confidence.

When people understand their money better, they:

- Worry less

- Delay decisions less

- Feel more in control

AI does not promise perfect outcomes. It simply reduces uncertainty, which is often the biggest source of financial stress.

Now that we’ve seen how AI is reshaping everyday financial decisions, the next step is to understand who benefits most and how.

In the next section, we’ll explore how different Indian profiles — students, salaried professionals, freelancers, business owners, and families — can use Smart Finance with AI in their own way.

Smart Finance with AI for Different Indian Profiles

One of the biggest strengths of Smart Finance with AI is that it is not one-size-fits-all. Money behaves differently for different people, and AI adapts to these differences far better than traditional finance methods.

Whether someone is earning a fixed salary, managing irregular income, running a small business, or handling household finances, AI in personal finance adjusts its insights based on real behaviour rather than assumptions.

Let’s look at how this works for different Indian profiles.

Students and First-Time Earners

For students and young earners, the biggest challenge is not income — it is understanding money.

Smart Finance with AI helps beginners by turning everyday transactions into learning moments. Instead of complex financial theory, AI-based money management tools show simple insights such as where pocket money or stipends are being spent and how quickly small expenses add up.

This early exposure to AI financial planning helps build healthy habits before mistakes become expensive. For beginners, AI acts more like a teacher than a tool.

Salaried Professionals

For salaried individuals, income is usually predictable, but expenses rarely are. EMIs, subscriptions, lifestyle spending, and family responsibilities often grow quietly over time.

Smart Finance with AI helps salaried professionals by analysing spending trends, identifying areas where money leaks happen, and aligning monthly savings with long-term goals. Because AI works continuously, it highlights problems early rather than at the end of the month.

This makes AI money management especially useful for professionals trying to balance savings, investments, and daily expenses without stress.

Freelancers and Gig Workers

Freelancers and gig workers face a different reality. Income is irregular, cash flow is uncertain, and financial planning often feels unstable.

Here, Smart Finance with AI becomes even more valuable. By tracking income patterns over time, AI helps estimate realistic saving capacity, identify lean periods, and avoid overspending during high-income months.

For freelancers, AI in personal finance is less about budgeting strictly and more about creating stability in an otherwise flexible income structure.

Small Business Owners and Solopreneurs

For small business owners, personal and business finances often overlap. This makes decision-making complex and sometimes emotional.

Smart Finance with AI helps by bringing structure and clarity. It highlights cash flow trends, identifies periods of strain, and supports better short-term planning. Instead of relying only on intuition, business owners can use AI-backed insights to understand what is actually happening financially.

In the Indian context, where small businesses operate with thin margins, AI finance tools help owners make informed decisions without needing advanced financial expertise.

Families and Homemakers

In many Indian households, homemakers manage daily finances even if they are not directly earning. This role requires constant decision-making, often without clear data.

Smart Finance with AI supports family finance by making household spending visible and predictable. It helps track recurring expenses, plan for education or emergencies, and maintain balance between needs and wants.

Here, AI financial planning reduces stress by replacing guesswork with clarity.

Why This Matters

The true power of Smart Finance with AI lies in its flexibility. It does not demand financial perfection or technical knowledge. It adapts to real people, real income patterns, and real responsibilities.

Once people see how AI fits into their financial life, it stops feeling like technology and starts feeling like support.

Now that we understand who can benefit from Smart Finance with AI, the next step is to understand why it works so well.

In the next section, we’ll explore the key benefits of using Smart Finance with AI and how it improves everyday financial decision-making.

Benefits of Using Smart Finance with AI in Everyday Life

The real value of Smart Finance with AI is not in technology itself, but in how it quietly improves everyday financial decisions. Most people don’t fail at money management because they lack discipline. They struggle because they lack timely insight. AI helps bridge that gap.

One of the biggest benefits of using AI in personal finance is clarity. Instead of vague assumptions like “I think I spend too much” or “I should be saving more,” AI shows clear patterns backed by data. When people can see their financial behaviour clearly, better decisions often follow naturally.

Another important benefit is reduced mental effort. Managing money traditionally requires constant attention — tracking expenses, remembering bills, reviewing statements, and planning ahead. AI money management systems reduce this load by working in the background. They organise information automatically and bring only the most important insights to your attention.

This makes finance feel less overwhelming, especially for beginners.

Smart Finance with AI also improves consistency. Human motivation goes up and down, but AI systems operate steadily. They continue tracking, analysing, and learning even when users are busy or distracted. Over time, this consistency leads to better habits without the pressure of strict self-control.

For many Indians, emotional decision-making is another challenge. Fear during market volatility, guilt around spending, or overconfidence during high-income periods often leads to poor outcomes. AI financial planning helps by introducing objectivity. It doesn’t react emotionally; it highlights trends calmly, helping people pause and think before acting.

There is also a long-term benefit that is often overlooked: confidence. When people understand their money better, they feel more in control. Financial decisions become less stressful and more intentional. This confidence is especially valuable in a country like India, where financial literacy levels vary widely and advice is often conflicting.

In practical terms, the benefits of Smart Finance with AI include:

- Better visibility into income and expenses

- More realistic budgeting and saving

- Improved financial discipline without stress

- Reduced emotional and impulsive decisions

- Stronger long-term financial awareness

What makes these benefits powerful is that they build gradually. There is no need for drastic changes or advanced knowledge. Small insights, applied consistently, create meaningful improvement over time.

However, it is also important to understand that AI is not perfect. Like any tool, it has limitations and must be used responsibly.

In the next section, we’ll look at common myths, risks, and responsible use of Smart Finance with AI — so expectations remain realistic and balanced.

Myths, Risks, and Responsible Use of Smart Finance with AI

As Smart Finance with AI becomes more popular, it is often surrounded by exaggerated claims and unnecessary fears. To use AI in personal finance effectively, it is important to separate reality from myths and understand its limitations clearly.

One common myth is that AI will completely take over financial decision-making. In reality, AI money management tools do not replace human judgement. They analyse data and offer insights, but the final decision always remains with the user. AI can suggest, warn, or highlight trends, but it cannot understand personal priorities, emotions, or life goals the way humans do.

Another misconception is that AI guarantees better financial outcomes. Smart Finance with AI improves awareness and consistency, but it does not eliminate risk. Markets can still fluctuate, income can still change, and unexpected expenses can still arise. AI helps people respond better to such situations, not avoid them entirely.

There is also a belief that AI is only useful for tech-savvy users or finance experts. This is no longer true. Many AI finance tools in India are designed for beginners, using simple language and visual insights. The technology works quietly in the background, allowing users to focus on understanding rather than operating the system.

That said, responsible use of Smart Finance with AI is essential.

AI systems are only as good as the data they receive. If financial information is incomplete or inaccurate, the insights may also be limited. This is why users should treat AI suggestions as guidance, not absolute truth.

Privacy and data security are another important consideration. While AI tools aim to improve financial planning, users must remain aware of where their data is stored and how it is used. Responsible AI use involves choosing platforms that value transparency and security.

Perhaps the most important point is expectation management. Smart Finance with AI is not a shortcut to wealth. It does not eliminate the need for patience, discipline, or long-term thinking. Instead, it acts as a support system that makes financial behaviour easier to understand and improve.

When used with the right mindset, AI becomes a helpful assistant rather than a decision-maker. It encourages awareness, reduces confusion, and supports better habits over time.

With myths clarified and limitations understood, the next logical step is to explore how someone can actually begin using Smart Finance with AI in a simple, practical way.

In the next section, we’ll outline a beginner-friendly roadmap to start using Smart Finance with AI without feeling overwhelmed.

How to Start Using Smart Finance with AI (A Beginner Roadmap)

Starting with Smart Finance with AI does not require a complete reset of your financial life. In fact, trying to do too much at once often creates confusion and frustration. The smartest way to begin is slowly, with intention.

For beginners, students, and AI-curious learners, the goal is not optimisation on day one. The goal is awareness first.

The first step is simply to let AI observe your financial behaviour. This means allowing an AI-based system to track income and expenses over a period of time without immediately trying to fix anything. During this phase, the focus should be on understanding patterns rather than judging them.

Once spending and income patterns become visible, the next step is to reflect. AI in personal finance works best when users pause and ask simple questions: Where does most of the money go? Which expenses repeat every month? Which ones add value, and which ones don’t?

Only after this clarity is built does planning make sense.

At this stage, AI money management tools can help set realistic budgets and savings goals. These are not rigid rules, but flexible guidelines based on actual behaviour. For beginners, this feels far more achievable than traditional budgeting methods that rely on ideal assumptions.

As confidence grows, users can slowly expand into AI financial planning. This may include setting medium-term goals, preparing for emergencies, or understanding basic investment alignment. There is no urgency here. Smart Finance with AI works best when it grows with the user’s comfort level.

A simple beginner approach looks like this:

- First, observe and understand spending patterns

- Then, adjust small habits based on AI insights

- Later, align savings and goals gradually

- Eventually, explore investing and long-term planning

What makes this approach effective is patience. AI for beginners is not about speed. It is about building a calm, informed relationship with money.

One important reminder at this stage is to stay selective. Not every feature needs to be used, and not every suggestion needs to be followed. Smart Finance with AI works best when it supports personal judgement rather than replaces it.

When used this way, AI stops feeling like technology and starts feeling like guidance.

Now that we understand how to begin, it is natural to wonder where all this is heading. How will Smart Finance with AI evolve in India over the coming years, and what should users realistically expect?

In the next section, we’ll look at the future of Smart Finance with AI in India and what the 2026 outlook looks like.

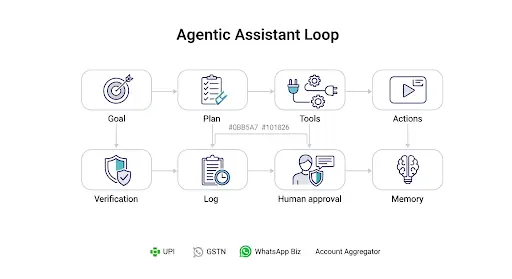

The Future of Smart Finance with AI in India (2026 Outlook)

The future of Smart Finance with AI in India will not arrive all at once. It will evolve quietly, becoming more integrated into everyday financial decisions rather than appearing as a separate “AI feature.”

By 2026, AI in personal finance is expected to move away from basic tracking and toward context-aware guidance. Instead of only analysing past data, AI systems will increasingly understand why financial behaviour changes — whether due to income shifts, life events, or economic conditions.

In India, this matters because financial lives are rarely linear. Career changes, family responsibilities, education expenses, and healthcare costs all influence money decisions. AI finance tools will become better at recognising these patterns and adjusting insights accordingly.

Another important shift will be simplicity.

As adoption grows, AI money management will become less technical and more conversational. Users will not need to interpret complex dashboards or reports. Insights will be shorter, clearer, and easier to act upon. This will make Smart Finance with AI more accessible to students, first-time earners, and non-technical users.

Trust will also play a bigger role.

As more Indians rely on AI financial planning, there will be greater emphasis on transparency, data security, and responsible design. Users will expect AI systems to explain why a suggestion is made, not just what to do. This explainability will be key to long-term adoption.

From a practical point of view, the future of Smart Finance with AI in India is likely to focus on:

- Better personalisation based on real-life behaviour

- Stronger integration across banking, payments, and planning

- More guidance, less information overload

- Support for long-term financial confidence, not short-term gains

What is unlikely to change is the role of the user.

AI will not replace personal responsibility. It will simply make financial behaviour easier to understand and improve. The human element — values, priorities, patience — will remain central.

In that sense, the future of Smart Finance with AI is not about smarter machines. It is about more informed people.

With this broader picture in mind, the final step is to help readers navigate what to explore next and how to continue learning without confusion.

In the next section, we’ll outline a simple internal learning path — what to read next and how to build knowledge step by step.

Internal Learning Path: What to Read Next on CamsRoy.com

Understanding Smart Finance with AI is not a one-time exercise. It is a learning journey that becomes clearer step by step. Once the foundation is in place, the next challenge is knowing what to explore next without feeling overwhelmed.

That is why learning in a structured way matters.

Instead of jumping between random tools or trends, readers should deepen their understanding of AI in personal finance by focusing on one practical area at a time. Each topic builds naturally on the previous one and strengthens overall financial awareness.

A simple learning path looks like this.

After understanding the concept of Smart Finance with AI, the next logical step is to explore how AI helps track expenses automatically. This helps turn abstract ideas into visible, everyday insights. Once spending becomes clear, budgeting and saving feel far more achievable.

From there, readers can move toward AI money management for savings and goals. This stage focuses on aligning daily behaviour with medium-term priorities, such as building an emergency fund or preparing for planned expenses.

Only after this clarity is built does AI financial planning and investing make sense. At this stage, AI acts as a support system for consistency and long-term thinking rather than a shortcut to returns.

On CamsRoy.com, each of these topics will be covered in dedicated, beginner-friendly articles that link back to this pillar guide. This allows readers to:

- Learn gradually, without information overload

- Revisit concepts when needed

- Build confidence through repetition and clarity

The idea is not to master everything at once, but to progress steadily.

Smart Finance with AI works best when learning is intentional and paced. By following a clear internal learning path, readers can move from curiosity to understanding, and from understanding to confident action.

With that roadmap in mind, it’s time to close this guide with one final thought.

In the final section, we’ll reflect on whether Smart Finance with AI is the right approach for you — and how to think about it realistically.

Final Thoughts: Is Smart Finance with AI Right for You?

Smart Finance with AI is not about becoming someone else with money. It is about understanding yourself better.

For many people in India, financial stress does not come from a lack of effort, but from uncertainty. Not knowing where money goes, not knowing if choices are right, and not knowing what to prioritise creates quiet anxiety. AI in personal finance helps reduce that uncertainty by offering clarity without judgement.

If you are someone who wants to:

- Understand your money without complex spreadsheets

- Make calmer financial decisions

- Improve habits gradually rather than drastically

- Learn about finance in a simple, practical way

Then Smart Finance with AI can be a helpful companion.

It is especially useful for beginners, students, and working professionals who want guidance rather than instructions. AI money management does not ask you to be perfect. It simply helps you notice patterns, reflect on behaviour, and improve one step at a time.

At the same time, it is important to remain realistic. AI is not a solution by itself. It does not replace patience, discipline, or long-term thinking. What it does offer is support — the kind that makes financial decisions feel less lonely and less overwhelming.

In the Indian context, where financial advice often feels either too technical or too generic, Smart Finance with AI fills an important gap. It brings structure without rigidity and insight without pressure.

Ultimately, the value of AI in finance depends on how it is used. When approached with curiosity, balance, and responsibility, it becomes more than technology. It becomes a tool for awareness and confidence.

And for many people, that confidence is the first real step toward better financial well-being.

Frequently Asked Questions (FAQs)

What does “Smart Finance with AI” actually mean?

Smart Finance with AI means using artificial intelligence to understand, manage, and improve your financial decisions. Instead of manually tracking expenses or guessing where money goes, AI analyses patterns in your income and spending and gives useful insights. It does not control your money — it simply helps you see things more clearly and make better decisions over time.

Is Smart Finance with AI suitable for beginners and students?

Yes, Smart Finance with AI is especially useful for beginners and students. Most AI finance tools are designed to be simple and visual, not technical. They help new users understand spending habits, budgeting basics, and saving behaviour without requiring prior financial knowledge or complex calculations.

Do I need technical or coding skills to use AI for personal finance?

No, you do not need any technical or coding skills. Modern AI in personal finance works in the background. Users interact with simple dashboards, summaries, or suggestions. The technology part is handled by the tool — your role is only to understand and act on the insights.

Is it safe to use AI for managing personal finances in India?

AI finance tools can be safe when used responsibly. They do not automatically move money or make decisions on your behalf. However, users should always choose trusted platforms, understand how their data is used, and avoid sharing sensitive information unnecessarily. AI should be treated as guidance, not authority.

Can AI really help me save more money every month?

AI helps save money indirectly by improving awareness. When you clearly see where money is going, unnecessary or inefficient spending becomes obvious. Small adjustments suggested by AI — when followed consistently — can lead to meaningful monthly savings without drastic lifestyle changes.

Will AI replace financial advisors or human judgement?

No. AI does not replace human judgement or professional advice. It works best as a support system that provides clarity and consistency. Personal goals, values, and life situations still require human thinking. Smart Finance with AI is meant to assist decisions, not replace responsibility.

Disclaimer:

This article is for educational and informational purposes only and should not be considered financial, investment, or tax advice. Readers should evaluate their personal circumstances or consult a qualified professional before making financial decisions. In the future, this page may include references to tools or services, some of which may be affiliate links. Such links do not influence the editorial content, and any recommendations are based on independent research and experience.